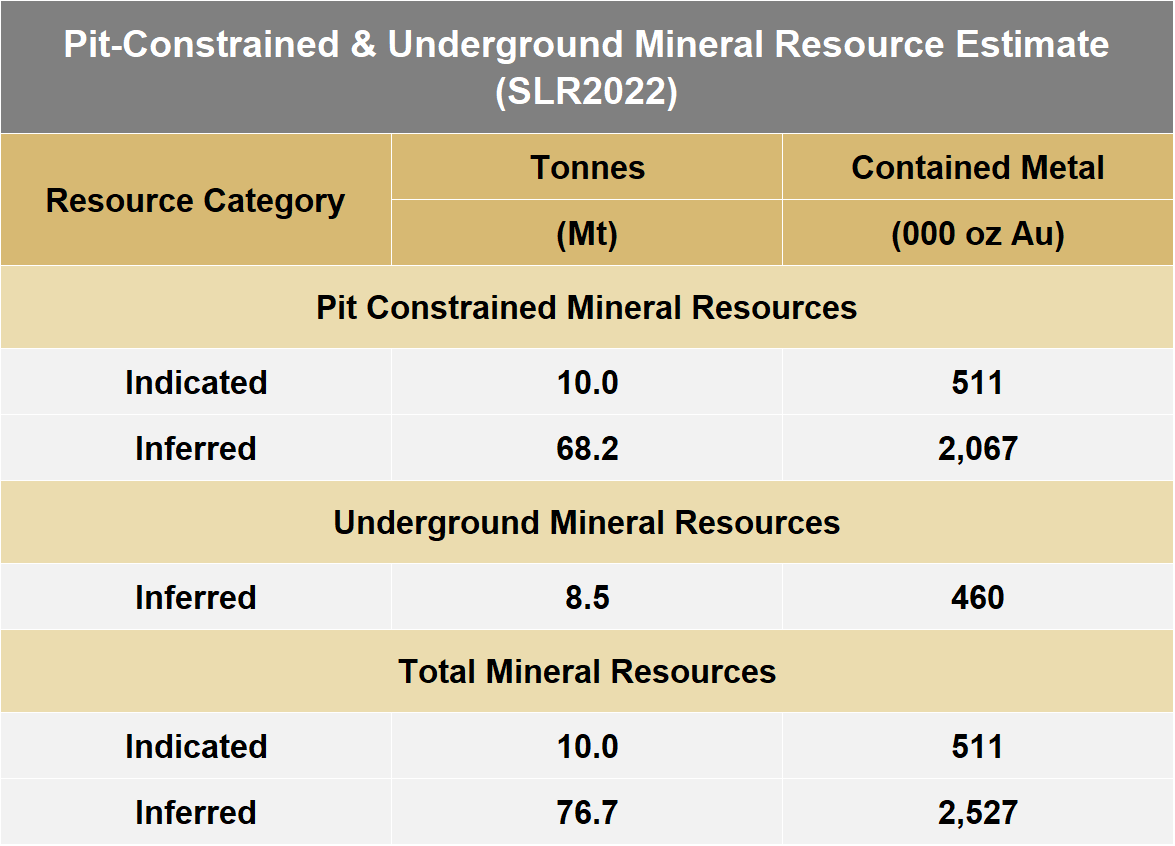

The Douay Gold Project hosts an established NI 43-101 mineral resource estimate, comprising:

- Indicated: 10.0 million tonnes grading 1.59 g/t Au for 511,000 contained ounces of gold

- Inferred: 76.7 million tonnes grading 1.02 g/t Au for 2.53 million contained ounces of gold

These estimates are based on a 0.45 g/t Au cut-off for open-pit resources and a 1.15 g/t Au cut-off for underground resources.

Further details on the key assumptions, parameters, and methodologies used in the resource estimate, along with potential legal, political, environmental, or other risks, can be found in the NI 43-101 Technical Report (SLR, 2022).

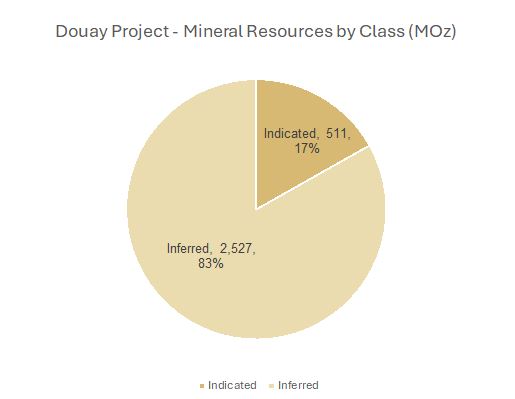

See Table 1and Chart 1for a detailed breakdown and Figure 6 and Figure 7 for MRE outlines.

Table 1: Douay Gold Project MRE

Chart 1: Douay Gold Project Mineral Resource Estimate (MRE); Mineral Resources by Class

Notes:

- The 2022 MRE is compliant with Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") Definition Standards (2014) incorporated by reference in National Instrument 43-101. The effective date for the Resource Estimate is March 17, 2022.

- Pit-constrained Mineral Resources are reported above a cut-off grade of 0.45 grams ("g") per tonne ("t") of gold ("Au") and underground Mineral Resources are reported with constraining shapes which were generated using a 1.15 g/t Au cut-off value and include low grade blocks falling within the mineable shapes.

- Pit-constrained Mineral Resources are reported within a preliminary pit shell using assumed mining costs of C$3.00/t mined (rock) and C$2.30/t mined (overburden), processing cost of C$9.10/t milled, G&A cost of C$2.70/t milled, and gold recovery of 90%.

- The Whittle pit shell used to estimate Mineral Resources used a long-term gold price of US$1,800 per ounce and a US$/C$ exchange rate of 0.80. However, the implied gold price for the Mineral Resources reported at the applied cut-off grade of 0.45 g/t would be significantly lower.

- Mineral Resources located outside the pit shell were reported on the basis of a potential underground mining operation at a gold cut-off grade of 1.15 g/t Au. This cut-off grade was based on mining costs of C$63/t and the same processing and G&A cost assumptions listed above.

- A minimum mining width of 3 metres ("m") was applied to the Mineral Resource wireframes.

Bulk density was interpolated for Nika, Porphyry, and 531 zones on a block per block basis using assayed values. For all other zones, bulk density ranging between 2.72 t/m3and 2.88 t/m3 was assigned to Mineral Resources based on the zone. - Numbers may not add due to rounding.

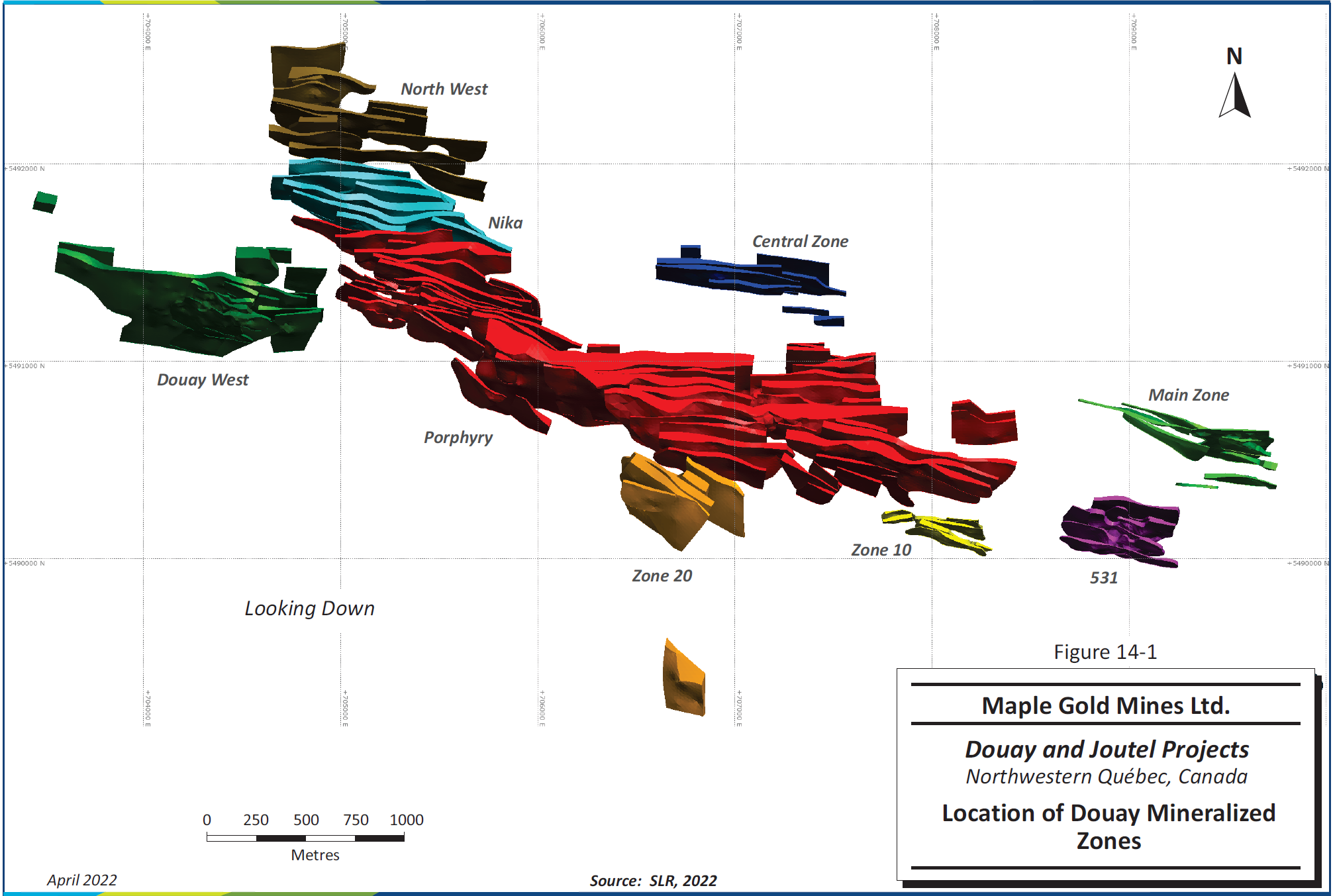

Figure 5: Douay and Joutel Gold Projects, Location of Douay Mineralized Zones (SLR, 2022)

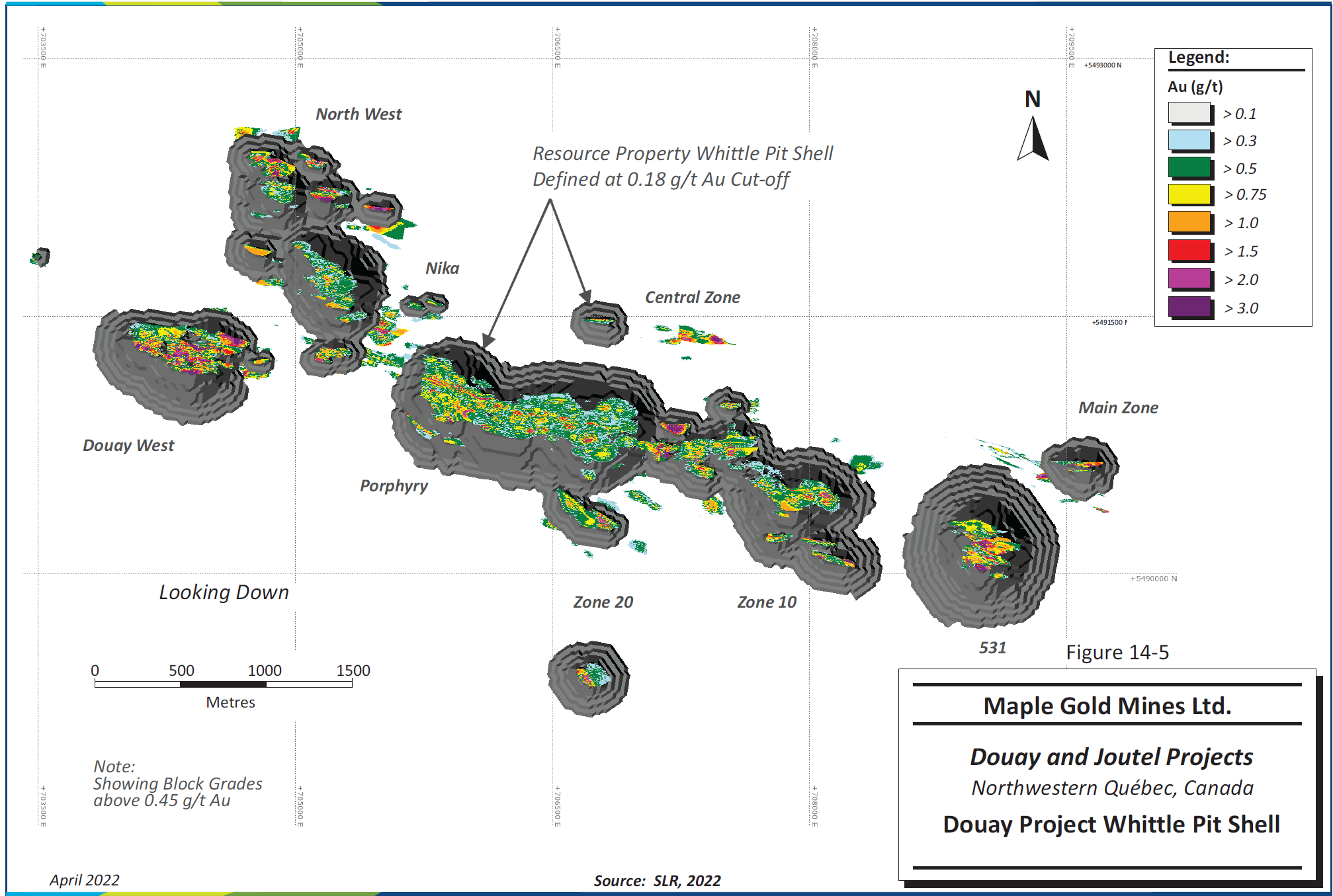

Figure 6: Douay and Joutel Gold Projects, Douay Project Whittle Pit Shell with Classified Blocks by g/t Au